سمت شغلی

شرکت

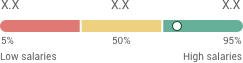

حقوق

آمار رزومههای ارسال شده

Job Description

The treasury manager is responsible for overseeing the organization’s treasury functions, including cash management, liquidity planning, investment strategies, and risk management. This role involves developing and implementing financial policies and procedures to optimize the organization’s financial performance while ensuring compliance with regulatory requirements.

Responsibilities

- Monitor and manage daily cash positions to ensure adequate liquidity for operational needs.

- Develop cash flow forecasts and implement strategies to optimize cash utilization.

- Oversee the organization’s investment portfolio, analyzing investment opportunities and performance.

- Develop and recommend investment strategies that align with the organization’s financial objectives.

- Identify, assess, and manage financial risks, including interest rate, foreign exchange, and credit risks.

- Develop and implement risk mitigation strategies to safeguard the organization’s financial assets.

- Prepare and analyze financial reports, forecasts, and budgets to support strategic decision-making.

- Conduct variance analysis and provide insights to senior management regarding financial performance.

- Ensure compliance with relevant financial regulations, internal policies, and industry standards.

- Prepare and submit required reports to regulatory authorities and internal stakeholders.

- Lead and mentor the treasury team, fostering a collaborative and high-performance work environment.

- Provide training and development opportunities to enhance team skills and knowledge.

- Work closely with accounting, finance, and operational teams to align treasury activities with overall business objectives.

- Liaise with banks and financial institutions to manage relationships and negotiate terms.

- Identify opportunities for process improvements within treasury operations.

- Implement best practices and technology solutions to enhance efficiency and accuracy.

Requirements

- Bachelor’s degree in Finance, Accounting, Business Administration, or a related field; a Master’s degree or professional certification (e.g., CFA, CTP) is preferred.

- 7+ years of experience in treasury, finance, or a related field, with at least 3 years in a managerial role.

- Strong analytical skills and proficiency in financial modeling and analysis.

- Excellent communication, leadership, and interpersonal skills.

- Knowledge of treasury management systems and financial software.

- Ability to work independently and collaboratively in a fast-paced environment.

Employment type

- Full Time

Job Category

Seniority

برای مشاهدهی شغلهایی که ارتباط بیشتری با حرفهی شما دارد،

موقعیتهای شغلی مشابه

برای مشاهدهی شغلهایی که ارتباط بیشتری با حرفهی شما دارد،

کارجویان

محصولات ایرانتلنت

کارفرمایان

© 2025 IranTalent.com همه حقوق محفوظ است. شرایط و قوانین شرایط و قوانین سرویس هد هانتینگ حریم خصوصی