Job Description

1. Carrying out matters related to endorsing shipping documents, including receiving commercial invoices, packing lists, certificates of origin, bills of lading, and inspection reports from the commercial unit, and reviewing documents received from the commercial unit and ensuring that there are no discrepancies between the documents. 2. Carrying out matters related to paying customs declarations, including receiving customs declarations from foreign commercial units and payment confirmations from the foreign purchasing unit, and reviewing the declarations to ensure that there are no discrepancies between shipping documents and declarations. 3. Requesting supplier codes in the accounting system by checking the accuracy of the submitted documents and the validity of the value-added certificate, creating them in the ERP system (Netsis), and announcing the created code to the foreign purchasing unit. 4. Receiving documents through the form for submitting external purchase costs, reviewing the required purchase documents, including: printouts of the created foreign purchase order, goods and services purchase invoices, relevant purchase warehouse receipt numbers according to the purchase order, proforma invoice, commercial invoice, packing list, cargo insurance policy, certificate of origin, inspection certificate, bill of lading, customs declaration, electronic receipt of customs declaration, and additional customs clearance costs, controlling the CEO's approval. , Invoice format according to standard formats and invoice date for registration in the current financial period, Checking the validity of the value added certificate of ancillary costs on the invoice issuance date on the ir.evat.www site in case of issuing an official invoice, Controlling invoice amounts, Registering documents and ancillary costs in the ERP system (Netsis), Calculating the cost of foreign purchases and closing the relevant order and sending a report of materials purchased in the relevant period to the foreign purchasing unit for registration in the purchase order process and converting items into rials

5. Receiving a written request from the contractor to prepare a letter of introduction to the requested social security branch, Reviewing the contractor's contract and preparing a letter of introduction of contract insurance in the organization's format, Receiving the minutes of the final delivery of the contract with the approval of the contractor and the project manager and the organization's management, Receiving documents related to the process of performing the work of manpower and machinery, Checking the contract completion date and the minutes of the delivery, Preparing the contractor's account report and calculating the gross amount of the contract and sending a letter of request for account reconciliation to the Social Security Organization

6. Preparing purchase and sale and value added reports from the ERP system (Netsis) microdocuments, Matching accounting reports and detailed reports of buyers and sellers, Preparing the TTMS file from the Tax Affairs Organization's website and preparing File for sending purchase and sale and import reports at the end of each solar season, preparing value-added reports and checking compliance with payable accounts subject to value-added tax and completing value-added tax declarations for submission at the designated time to the Tax Affairs Organization at the end of solar seasons

7. Preparing and sending periodic reports to the accounting manager, including a comprehensive report on the current status of contractors, a report on the cost of materials in rials and foreign currency, a report on the reconciliation of material purchases with inventory, and a report on the status of imports and a table of the cost of foreign purchases at the end of each month

8. Providing foreign purchase reports and images of contracts and reconciliations of insurance accounts received for contracts in the social security insurance audit

9. Providing reports on foreign purchases and seasonal purchases and sales, value-added tax, rent tax, etc. in the tax audit

10. Providing reports on foreign purchases and seasonal purchases and sales, value-added tax, rent tax, etc. in the annual independent audit

Employment Type

- Full Time

Job Category

Educations

Seniority

Details

Employment type

- Full Time

Job Category

Educations

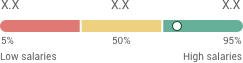

Seniority

To see more jobs that fit your career

Similar Jobs