Job

Company

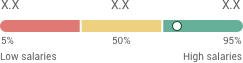

Salary

Applicant Insights

Job Description

- Manage and oversee the preparation and maintenance of local statutory books in compliance with applicable tax regulations.

- Prepare and review documents for Corporate Income Tax (CIT), Value-Added Tax (VAT), seasonal reports, excise duties, and Social Security Organization (SSO) audits.

- Coordinate and liaise with SSO and Tax offices to ensure smooth and timely execution of all business-related tax requirements.

- Analyze and monitor SSO deposit accounts, ensuring accuracy and timely payments.

- Prepare and submit quarterly VAT returns and seasonal reports, ensuring full compliance with regulatory requirements.

- Prepare and submit legal books as required by local regulations, ensuring all information is accurately recorded and reported.

- Collaborate with internal stakeholders to address tax-related inquiries and ensure efficient management of tax-related issues.

- Support and contribute to tax audits, assessments, and appeal processes, ensuring proper documentation and accurate filings.

- Continuously monitor and stay updated on changes to tax laws and regulations to ensure compliance and optimize tax strategies.

- Assess, monitor, plan, and manage the efficient utilization of cash and financial services in line with the objectives of the Company.

- Assist Finance Manager in day-to-day work & financial activities, and contribute to the overall cash management strategy.

- Be the primary contact and maintain good relationships with banks, and evaluate new banking products and services.

- Ensure accurate information maintenance of bank account, balance, bank systems, and bank mandate.

- Receive and disburse cash in accordance with company policies and procedures, including reconciliation between receipts/ payments versus bank statements.

- Recommend, implement, and maintain the treasury system and financing operational processes improvement.

- Support the finance manager in preparing the treasury/ finance report for meetings with the global treasury office/external parties, ensuring all reports are accurate and timely provided.

Requirements:

- Bachelor's or Master's degree in Accounting, Finance, or a related field.

- At least 7 years of experience in finance or accounting roles.

- Strong command of English, both written and verbal.

- Proficiency in accounting software and Microsoft Excel.

- Updated in tax regulations.

Employment type

- Full Time

Job Category

Seniority

To see more jobs that fit your career

Similar Jobs

To see more jobs that fit your career

Candidate

Irantalent Products

Employer

© 2025 IranTalent.com All rights reserved. Terms and Conditions Head Hunting Terms & Conditions Privacy policy