سمت شغلی

شرکت

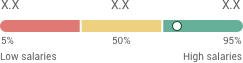

حقوق

آمار رزومههای ارسال شده

Job Description

This position exists to support the JTI tax function in Iran entities. The position is responsible for carrying out objectives of JTI entities in Iran for corporate tax, VAT, and social security objectives. The position is part of the global tax function and reports to the tax manager in IRAN.

Main Responsibilities:

- Manage tax risks and implement measures to mitigate any tax risk in JTI Iran entities.

- Manage tax reporting obligations for JTI Iran entities.

- Support tax audits and be the main point of contact for tax authorities and external consultants.

- Ensure cooperation between Global Tax and Entity Finance, GSC, and other local functions.

- Manage JTI tax compliance including timely review and submission of the tax returns (including - excise returns).

- Monitor legislative and regulatory tax law developments.

- Support TAX MANAGER IRAN in the implementation of tax strategy, tax risk analyses, and implementation of measures to mitigate tax risks.

- Manage company's tax compliance with the relevant tax law and practice including timely submission of the tax returns (CIT, VAT, excise).

- Manage the group's tax reporting obligations.

- Provide internal tax advisory (in particular VAT, CIT, excise, and rental tax).

- Prepare a cost of goods sold statement and other documents during a tax audit. Manage and coordinate tax-driven business initiatives locally or globally.

- -Manage the cooperation with tax authorities and consultants, liaise with tax authorities with the tax audits and other requests, and maintain cooperation with all departments within the company as well as global functions.

- Monitor legislative and regulatory tax law developments (CIT, VAT, excise tax, customs).

- Provide adequate support for financial planning for each planning cycle.

- Provide adequate support to the accounting department in each monthly close.

Requirements

- Bachelor's or Master's degree in Accounting, Tax, or Finance.

- At least 10 years of experience in domestic taxes in audit or business firms, or similar positions.

- International tax knowledge is an advantage.

- Fluent in Rahkaran System.

- Fluent in Microsoft Office, especially Excel, and PowerPoint.

- Negotiation skills.

- Excellent command of English, written and verbal.

Employment type

- Full Time

Job Category

Seniority

برای مشاهدهی شغلهایی که ارتباط بیشتری با حرفهی شما دارد،

موقعیتهای شغلی مشابه

برای مشاهدهی شغلهایی که ارتباط بیشتری با حرفهی شما دارد،

کارجویان

محصولات ایرانتلنت

کارفرمایان

© 2024 IranTalent.com همه حقوق محفوظ است. شرایط و قوانین حریم خصوصی