Job

Company

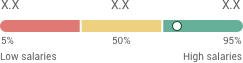

Salary

Applicant Insights

Job Description

- Liaise with accounting for preparation and declaration of VAT and seasonal reports for accurate reports of sales/purchase transactions on the new MOF website.

- Timely preparation and submission of WHT, maintaining MOF forms for payment, retaining proper documentation, and preparing proper analysis to respond to any MOF/Audit inquiries.

- Computation of the CIT provision, ensuring the accuracy of tax returns, tax provisions, declaration of tax return, providing the amount of CIT payment, retaining required reports and documents related to tax provision and CIT to support tax positions examination by tax authorities.

- Prepare and submit monthly and quarterly tax input to be entered in the Siemens Energy tax tool (being aware of IFRS, Deferred tax assets, and Liabilities).

- Liaise with accounting, business area, and TCF to provide proper planning and forecasting of tax provisions and tax payments.

- Provide any letter to MOF or any level of Tax committees/council for clarification of business/company tax inquiries, attend such meetings, and share the result upon alignment with Siemens Energy Management.

- Liaise with accounting and auditor for proper tax provision booking, regular monitoring of tax accrual balance to ensure correct tax balance in the accounts, and support for correct tax disclosure in the note of the financial statements of the company.

- Prepare defensive bills with proper documentation to any level of MOF dispute committee, follow up tax files within MOF jurisdictions, and monitor the status of tax files.

- Collaborate, and interact within the company, to collect enough documents, analyze collected information, prepare any information as per MOF forms, and challenge MOF with strong comments and documents and defense company’s transaction against any MOF assessments.

- Liaise with HUB for preparing analysis reports for tax, tax risk, tax cash, tax provision, tax risk, or any ad-hoc report.

- Inform tax law changes, cascade new laws within the company and ensure implementation within the company, assist implementation of new changes in regulation as per global or local law, active role in improvements of processes, actively support for digitalization of any process, if any.

- Support company and business area, HUB, or HQ with any tax inquiries in relation to business, projects, capital, accounting, and HR topics.

- Support the provision of tax clauses in the company’s contracts.

Requirements

- Bachelor's degree (or higher) in Accounting, or Financial Management.

- At least 7 years of experience in the same area.

- Strong knowledge of tax rules and regulations.

- Excellent analytical skills with the ability to interpret data and make informed decisions.

- Exceptional negotiation skills with tax organization.

- Strong communication and interpersonal skills to collaborate effectively with internal teams and external suppliers.

- Ability to work under pressure and meet tight deadlines without compromising quality.

- Work experience in multinational companies.

- High accuracy and self-discipline.

Employment Type

- Full Time

Job Category

Seniority

Details

Employment type

- Full Time

Job Category

Seniority

To see more jobs that fit your career

To see more jobs that fit your career

Candidate

Irantalent Products

Employer

© 2025 IranTalent.com All rights reserved. Terms and Conditions Head Hunting Terms & Conditions Privacy policy