Job Description

This position is responsible for the treasury function, cash management, and financial risk management of JTI entities located in Iran, within the limits defined by local regulations and JTI’s global policies and procedures (e.g., JTI Operating Guidelines, Treasury Manual, Compliance Framework). The role ensures liquidity, banking efficiency, and regulatory alignment in a complex and evolving financial environment. It requires deep expertise in international sanctions frameworks and the ability to proactively assess and respond to new sanctions and local legislative changes. The Treasury Manager also plays a critical role in safeguarding business continuity by anticipating financial disruptions, maintaining access to liquidity, and ensuring uninterrupted execution of core treasury operations. The role includes stakeholder engagement across Finance, Legal, Compliance, and Global Treasury, and carries decision-making authority within approved treasury limits.

Main Areas of Responsibility

• Cash Flow Forecasting and Cash Management:

- Evaluate cash inflows/outflows from all sources for effective liquidity planning

- Prepare and monitor annual cash flow forecasts aligned with Budget & Planning

- Monitor investment levels and external financing needs

- Track Iranian money market trends and regulatory changes to advise management

- Optimize treasury operations (FX transactions, borrowing, payments, netting)

- Minimize bank charges and protect liquid assets

- Lead restructuring of external financing strategy

- Coordinate International Treasury Requests (ITRs) in line with JTI’s financing strategy

- Ensure compliance with applicable sanctions regulations when managing FX and cross-border flows

- Proactively assess and adjust treasury strategy in response to new sanctions or legislative changes

- Maintain business continuity by ensuring liquidity access and operational readiness under volatile conditions

• Operation Management:

- Ensure timely execution of payments and collections in line with Iranian legal and JTI policy requirements

- Review and validate banking documentation

- Ensure accurate posting of banking transactions

- Ensure all operational flows remain compliant with evolving sanctions and local legislation

- Implement controls and fallback procedures to support uninterrupted treasury operations

• Bank Relationship Management:

- Represent JTI IRAN LLC in banking relations to maintain and enhance partnerships

- Monitor banking system developments and recommend improvements

- Evaluate and rate banks for Finance management

- Review and revise bank agreements in coordination with Legal

- Assess bank compliance with sanctions and FX regulations before onboarding or initiating transactions

- Maintain proactive dialogue with banks to anticipate and mitigate risks from regulatory changes

- Ensure banking network resilience to support business continuity in case of disruptions or de-risking events

• Credit Management:

- Control customer credit limits and payment terms to safeguard receivables

- Ensure proper handling of customer contracts and bank guarantees

- Track guarantees and report to relevant stakeholders

- Manage guarantee limits and submit ITRs for approvals

• Project Management & Controlling:

- Ensure timely implementation of global and local treasury-related projects

- Provide technical support for local initiatives

- Ensure all treasury-related projects incorporate sanctions compliance and legislative risk assessments

- Embed business continuity considerations into treasury system upgrades and process changes

- Ensure compliance with JTI policies and procedures

- Execute Management Controls and JSOX controls as per GRM

- Integrate sanctions and legislative monitoring into treasury control framework

- Monitor and test controls that support financial continuity and risk mitigation

Knowledge, Skills, Experience Required

Education:

• University degree in Business Administration, Economics, Finance, or related disciplines. MBA preferred.

Work Experience:

• Minimum 5-7 years of managerial experience, preferably in a multinational company operating in Iran.

Language Skills:

• Fluency in English

Functional Skills:

• Proficiency in MS Office and ERP systems (SAP preferred)

• Strong understanding of Iranian banking regulations, FX controls, and financial reporting

• Experience in treasury operations, banking relationship management, and financial statement analysis

• Familiarity with Iranian tax/customs procedures and Central Bank guidelines

• Deep working knowledge of international sanctions frameworks and their impact on cross-border transactions, banking operations, and FX sourcing

• Ability to proactively monitor, interpret, and act on new sanctions and legislative developments affecting treasury and business flows

• Strong focus on business continuity, including contingency planning for liquidity, banking access, and regulatory disruptions

• Ability to engage internal stakeholders and escalate high-risk exposures appropriately

Employment Type

- Full Time

Job Category

Educations

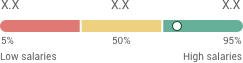

Seniority

Details

Employment type

- Full Time

Job Category

Educations

Seniority