Job Description

As a Tax Manager your responsibilities will be beyond executional functions. You will be responsible for process improvement, development, implementation of the Corporate Tax Strategy, and maintaining good relations with key external advisors. • Manage tax and transfer pricing functional area in Iran • Manage all relevant tax audits for the affiliate in cooperation with local tax advisor and Finance and F&O director. This includes ongoing documentation of relevant processes for tax office in areas of Corporate Tax, VAT, WH, and Seasonal Reporting • Manage all tax audits, tax disputes, customs/duty investigations and local investments/expansions in cooperation with F&O Director, Local Tax Advisor and IO tax director • Participate in reporting and documentation of all relevant tax/custom matters, internally within Novo Nordisk, and externally in compliance with Iranian tax/custom regulations and practices (in collaboration with Tax Director) • Ensure that issues are being analysed and optimised before any relevant business driven decisions are executed in close cooperation with Iran F&O Director and IO Tax Director • Train relevant affiliate staff to ensure high quality of tax and transfer pricing understanding and reporting to Corporate Tax • Monitor change to Iranian tax legislation and rules that impact specific tax treatment and use of external tax advice • Regular monitoring of tax matters in the affiliate and providing relevant training to local team in line with use of external tax advisor

Requirements

• Relevant degree in economy or finance (e.g. M.Sc. in accounting, Finance or equivalent) with focus on (international) tax legislation and planning regularly technical tax updates (e.g. tax seminars etc.) • Minimum 5 years of relevant work experience including transfer pricing • Previous employment in a big 4 accounting firm, International position, International tax, General taxation, and Pharma industry is a big advantage • Strong knowledge on local rules and regulations in corporate and tax area • Independent, responsible and conscientious, with high degree of integrity, tenacity and ability to judge • Strong English and Farsi verbal and written communication skills • IT literate including professional data discipline • confident to work in close cooperation with high-level executives and people of different cultural background Working at Novo Nordisk At Novo Nordisk we recognize that it is no longer good enough to aspire to be the best company in the world. We need to aspire to be the best company for the world and we know that this is only possible with talented employees with diverse perspectives, backgrounds and cultures. We are therefore committed to creating an inclusive culture that celebrates the diversity of our employees, the patients we serve and the communities we operate in. We commit to an inclusive recruitment process and equality of opportunity for all our job applicants. We are happy to discuss flexible working, depending on the role and subject to business needs. Due to high volume of application being received for this role, please note that only qualified candidates will be contacted. Millions rely on us To work for Novo Nordisk you will need the skills, dedication and ambition to change lives for the better for millions of patients living with diabetes and other chronic diseases. In exchange, we offer the chance to be part of a truly global workplace, where passion and engagement are met with opportunities for professional and personal development.

Employment type

- Full Time

Job Category

Educations

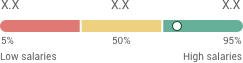

Seniority

برای مشاهدهی شغلهایی که ارتباط بیشتری با حرفهی شما دارد،

موقعیتهای شغلی مشابه