Job Description

● Managing all aspects of internal audit regarding the financial process of the company. ● Assisting in the annual audit development plan of the company. ● Analyzing financial data to identify process/control weaknesses and advise audit approach and testing. ● Communicating key company initiatives and critical changes, e.g., system implementations, accounting policy changes, and regulatory and compliance changes. ● Managing performance of internal audit assignments, reviewing work papers, and audit reports. ● Scheduling and planning internal audits; initiating project planning, assessing risk, and developing audit direction. ● Performing internal audit work, including plan preparation, work papers, finding, and associated reports verifying the accuracy of financial records pertaining to assets, liabilities, receipts, expenditures, and related transactions. ● Interacting with staff, as needed, and external audit and law enforcement agencies. ● Participating in the development, implementation, and maintenance of policies, objectives, short-and long-range planning; developing and implementing projects and programs to assist in accomplishing established goals. ● Participating in various joint projects with other teams of IA function. ● Presenting results to the top-level management and audit committee. ● Designing and developing procedures to ensure that the information required to provide assurance is captured in such a manner that reporting is efficient, accurate, reliable, and effective. ● proactively forecasting and addressing risks and issues to minimize the impact on the organization. ● Reporting to management about asset utilization and audit results and recommending changes in operations and financial activities. ● Collecting and analyzing data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies. ● Inspecting account books and accounting systems for efficiency, effectiveness, and use of accepted accounting procedures to record transactions.

Requirements

● At least a Bachelor's degree in Finance, or Accounting. ● At least 5 years of related experience and 2 years of managerial roles. ● Knowledge of auditing policies, IFRS and national standards, and procedures. ● Good knowledge of corporation tax, VAT, local labor laws, business laws, and SEO guidelines. ● Knowledge of legal documentation requirements. ● Fluent in English.

Employment type

- Full Time

Job Category

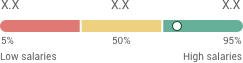

Seniority

To see more jobs that fit your career

Similar Jobs